Highlights

Seamless Data Connectivity

Connect effortlessly to 100+ data sources including cloud databases, warehouses, business apps, and files. Start analyzing in minutes without heavy engineering

Powerful Data Preparation And Governance

Blend, clean, and enrich your data with visual pipelines. Maintain data quality with audit trails, granular access controls, and enterprise-grade security

Intuitive BI & Visualization

Leverage CHITR’s top-tier visualization engine with 40+ interactive chart types, drag-and-drop dashboards, and customizable templates

AI Augmented Analytics

Utilize AI-powered assistants & agentic dashboards to get instant insights, automate report generation, and enhance decision-making with natural language

Collaboration & Sharing

Share reports and dashboards securely across teams with fine-grained role permissions, scheduled exports, embedded comments, and integrations.

Scalable And Reliable Infra

Cloud-native, highly available infrastructure designed to scale from small teams to global enterprises with minimal latency and maximum uptime.

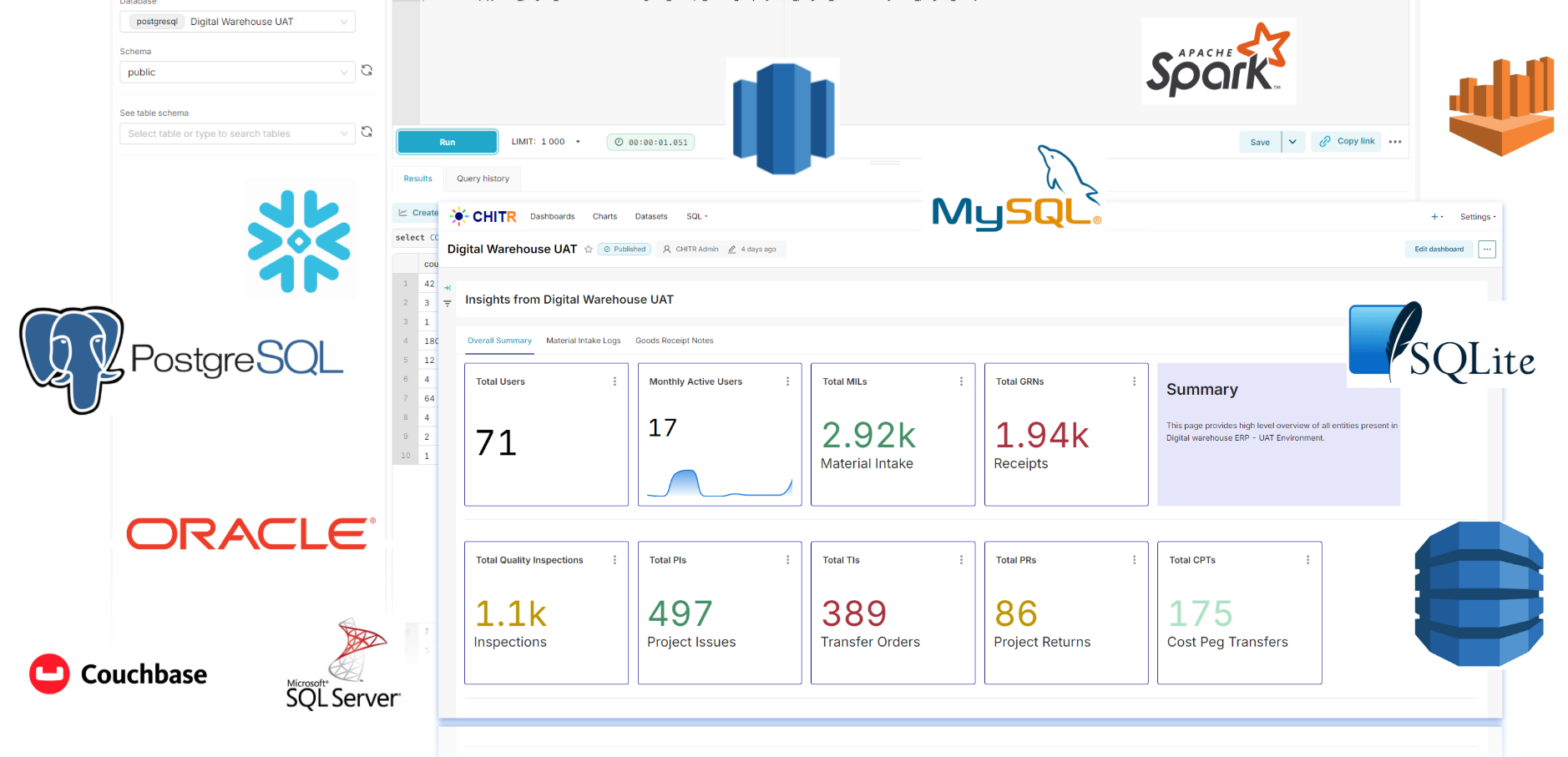

40+ Databases supported

AWS Athena, AWS DynamoDB, AWS Redshift, Apache Doris, Apache Drill, Apache Druid, Apache Hive, Apache Impala, Apache Kylin, Apache Pinot, Apache Solr, Apache Spark SQL, Arc (Basekick Labs), Ascend.io, Azure MS SQL, ClickHouse, CockroachDB, Couchbase, CrateDB, Denodo, Dremio, Elasticsearch, Exasol, Google BigQuery, Google Sheets, Firebolt, Hologres, IBM Db2, IBM Netezza Performance Server, MySQL, OceanBase, Oracle, Parseable, PostgreSQL, Presto, SAP Hana, SingleStore, StarRocks, Snowflake, SQLite, SQL Server, TDengine, Teradata, TimescaleDB, Trino, Vertica, YDB, YugabyteDB

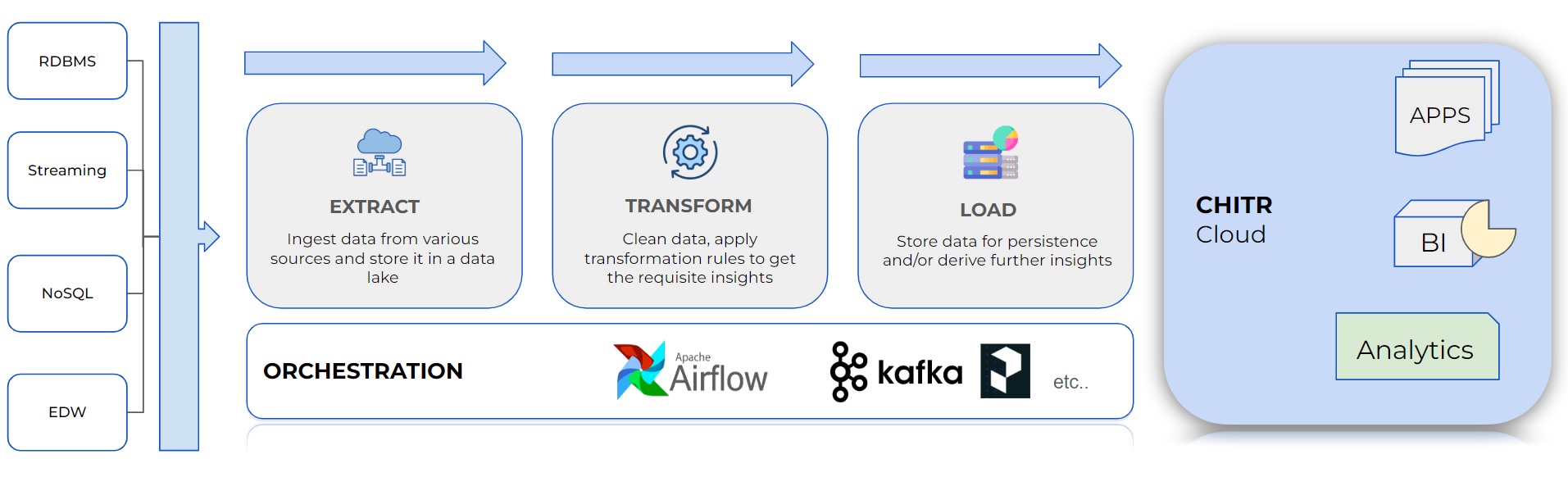

Architecture & flow of Data

Data needs vary based on the volume to be processed. As a result, Data pre-processing needs also vary. Large organizations require ETL pipelines to be set up for transforming Big Data before getting insights, where as small apps can directly plug and play. Small App teams can opt for the Starter plan where as large organizations with big data needs can choose the enterprise plan.

Pricing Plans

Choose a plan as per your needs. If Data pre-processsing is not required, choose the Starter plan. For Large Data needs which require ETL Piplines or if you require deep customization or your own data apps, choose Enteprise plan.

If you have custom needs, please feel free to contact us no matter how large or small your data is.

Starter

- ✔️ Unlimited users

- ✔️ Unlimited Dashboards and Charts

- ✔️ 40+ Visualization Types

- ✔️ 40+ Databases

- ✔️ RBAC - Role based access control

- ✔️ SQL Editor

- ✔️ No Code Chart Builder

- ✔️ Shared Instance

- ✔️ SLA

$110 / month billed annually.

₹8000 / month billed annually - Special offer for Indian companies.

Professional

- ✔️ Unlimited users

- ✔️ Unlimited Dashboards and Charts

- ✔️ 40+ Visualization Types

- ✔️ 40+ Databases

- ✔️ RBAC - Role based access control

- ✔️ SQL Editor

- ✔️ No Code Chart Builder

- ✔️40 Hrs of Support from 1 Data Engineer

- ✔️ API

- ✔️ Dedicated Instance

- ✔️ SLA

$140 / month billed annually.

₹10000 / month billed annually - Special offer for Indian companies.

Enterprise+

- ✔️ Everything in Professional Plan

- ✔️ Deep Customization as per request

- ✔️ Agentic AI(Coming soon)

- ✔️ SLA

Price of Professional Plan + Extra Infra costs(if opted) + Costs of Customization

Industry Use Cases

-

Banking: Revolutionize banking analytics with fraud detection, transaction monitoring, customer insights, and regulatory compliance dashboards.

-

Finance & Insurance: Deep analytics for portfolio management, fraud detection, and compliance reporting—helping financial firms make confident decisions.

-

Retail & E-Commerce: Optimize sales, inventory, campaigns, and product data with unified retail insights.

-

Healthcare: Unlock patient insights and streamline clinical KPIs with interactive healthcare analytics dashboards.

-

Marketing & Advertising: Power campaign tracking, segmentation, and actionable insights with marketing analytics and data visualization.

-

Education: Measure performance, trends, attendance, and engagement across campuses with dashboards.

-

Manufacturing: Improve production, monitoring, and quality control through scalable industrial dashboards.

-

Government & Public Sector: Enhance policy planning, resource allocation, and population analytics with secure customizable platforms.

-

Energy & Utilities: Monitor energy usage, equipment health, and asset management with analytics.

-

Telecommunications: Track network performance, service quality, and usage patterns efficiently with analytics tools.

Empower Your Banking Analytics with CHITR

CHITR serves as a powerful Business Intelligence (BI) platform for the banking and financial services domain, helping organizations harness data efficiently for strategic, operational, and compliance purposes. It streamlines financial data analysis, visualization, and reporting, offering a single platform to make sense of complex transactional, customer, and regulatory datasets.

CHITR serves as a powerful Business Intelligence (BI) platform for the banking and financial services domain, helping organizations harness data efficiently for strategic, operational, and compliance purposes. It streamlines financial data analysis, visualization, and reporting, offering a single platform to make sense of complex transactional, customer, and regulatory datasets.

Let's talk

Tell us which plan works best for you and when you’d like to connect — we’ll confirm your appointment and get you started immediately.

Contact Us

Address

Banashankari 3rd Stage

Bangalore

Karnataka, India